Understanding the fundamentals of Medicare is crucial to making informed decisions about your healthcare coverage. It allows you to navigate the complexities of Medicare, including understanding the services covered, enrollment timelines, and eligibility requirements.

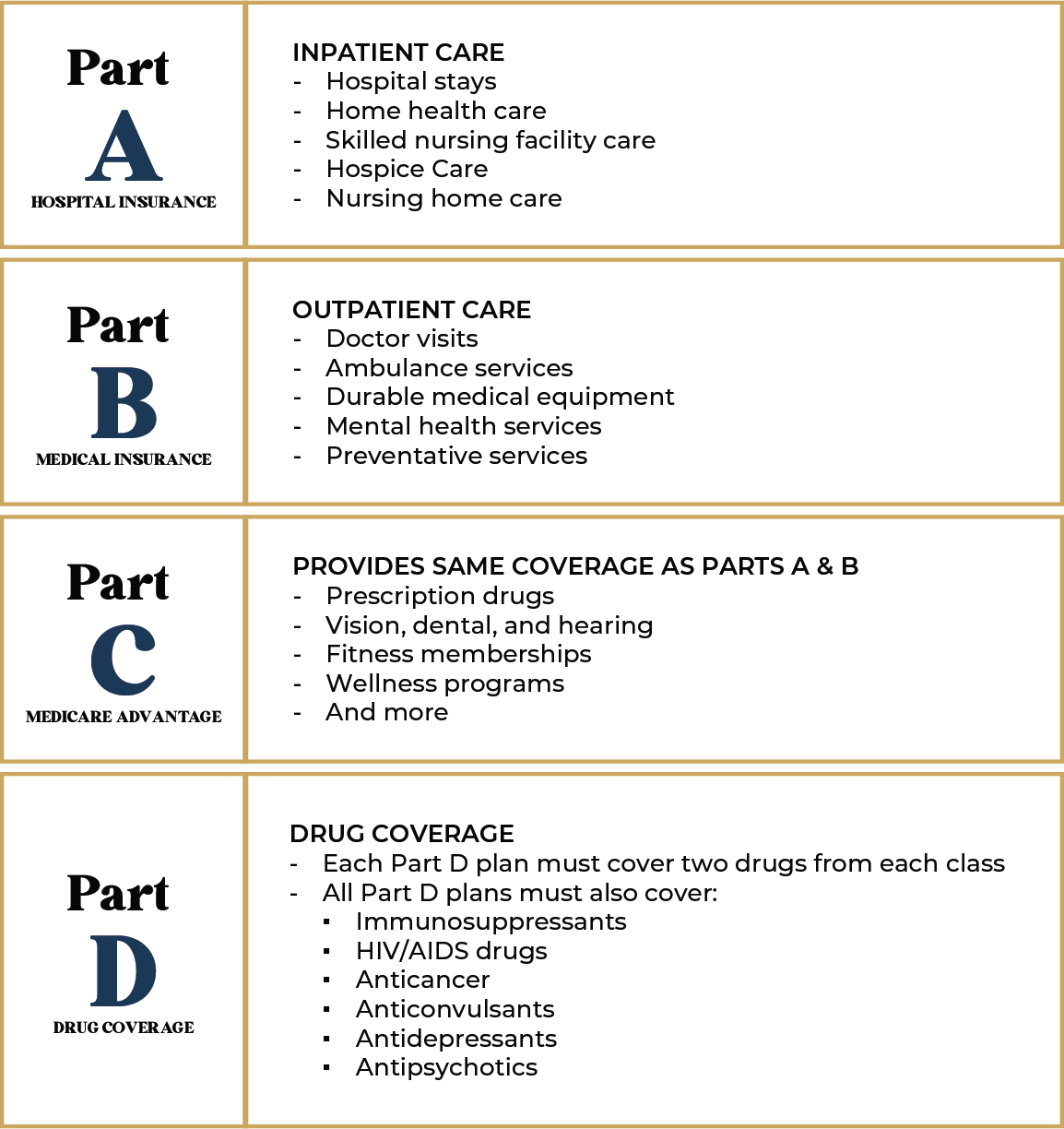

To comprehend your Medicare options fully, it’s important to familiarize yourself with the different parts of Medicare:

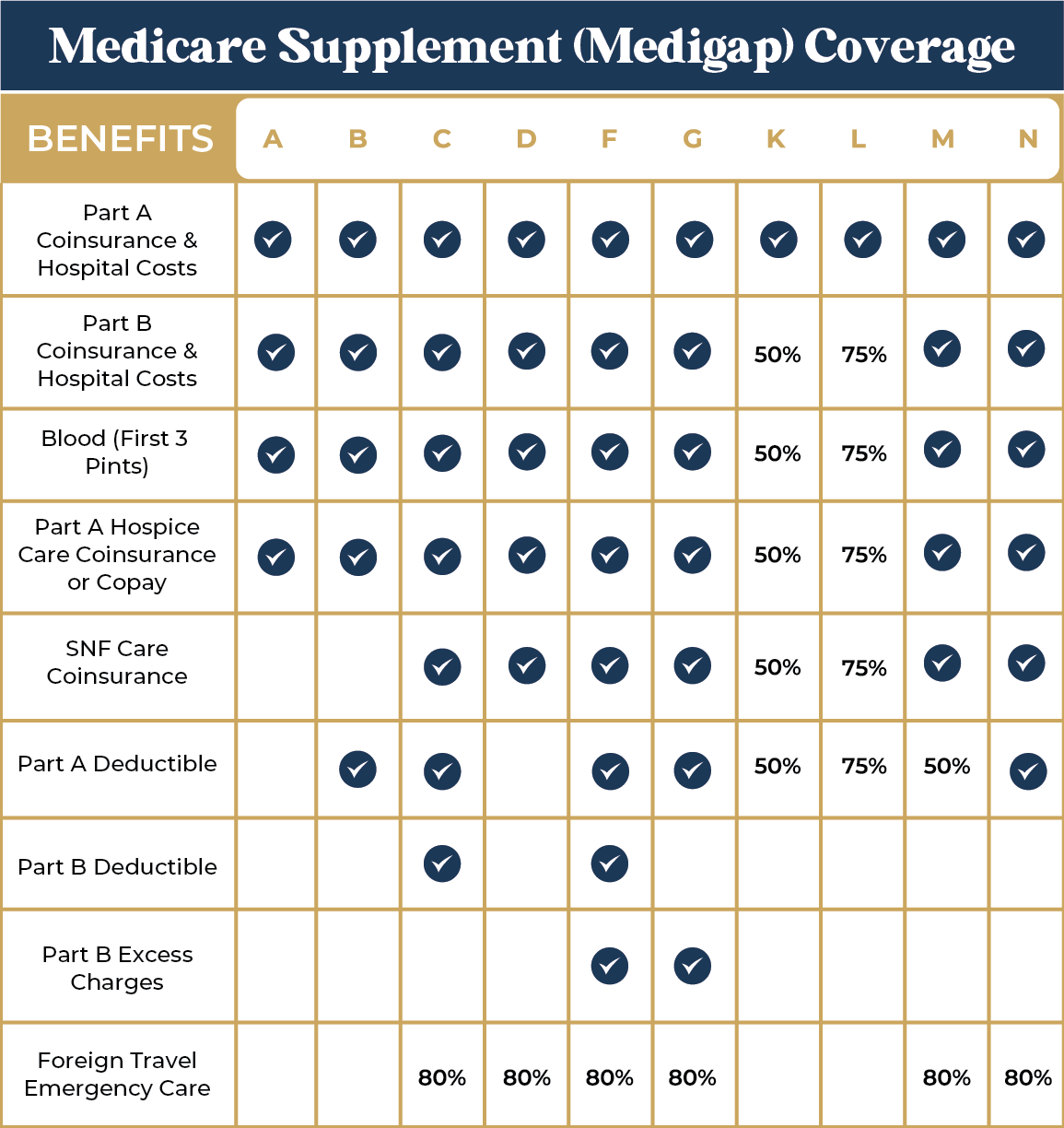

Medicare Supplement plans, also referred to as Medigap plans, offer coverage for out-of-pocket expenses associated with Original Medicare (Part A and Part B). These plans, provided by private insurance companies, help cover costs such as copayments, coinsurance, and deductibles. Explore the various Medigap plans and their coverage to determine the best fit for your needs.

Now that you understand the coverage provided by Medicare, let’s examine the eligibility criteria:

Once you meet the eligibility requirements for Medicare, it’s crucial to understand the enrollment periods available to you. Take a look at the following Medicare enrollment periods, which allow you to enroll in Medicare for the first time or make changes to your existing coverage:

This period starts three months before your 65th birthday and ends three months after. This period marks your eligibility for Medicare. It is recommended you enroll during this period as soon as possible to avoid any coverage gaps.

The GEP begins January 1 and ends March 31 of every year. You can enroll in Medicare during the GEP if you missed your IEP. However, you may have to pay late enrollment penalties if you enroll during this period.

You can avoid late enrollment penalties if your qualify for a SEP. This period grants you the chance to delay your Medicare enrollment if you’ve experienced certain circumstances.

This 6-month period becomes available when you are 65 and your Part B coverage is effective. This period allows you to buy a Medigap plan without the worry of being denied coverage.

This period begins January 1 and ends March 31 of every year. If you have a Medicare Advantage plan, you can use this period to switch to a new plan or go back to Original Medicare. You can only switch plans once during this time.

AEP begins October 15 and ends December 7 of every year. If you are enrolled in Medicare, you can use this time to review your plan and make changes if necessary. Any and all changes will become effective on January 1 of the following year.

At Capitol City Insurance, we are committed to simplifying Medicare for you. Our team of Medicare experts is here to assist you, whether you have questions about the enrollment process or need guidance on choosing the right coverage. Schedule a free consultation with us today and embark on your Medicare journey with confidence!

Let’s start by collecting some basic information. Please verify your information and click “Submit” to process your request.

*I understand and I agree that by submitting my information, a licensed insurance representative will contact me for the purpose of providing additional information on insurance programs available in my state.*